Outsourced Finance

What is Outsourcing?

Are you struggling to get timely information from your finance dept?

Has the business outgrown its finance system, or the ability of the existing finance staff?

Are the volumes so high the finance dept can’t cope?

Finance and accounting outsourcing (FAO) is increasing, with the global FAO market now estimated to be worth more than £24bn. The number of large contracts (valued at over £25m and/or where at least five processes are involved) has increased by nearly 50% since 2005.

In essence it is a service that replaces all or part of your current finance team. Payroll is probably to most common of these, but increasingly entire finance operations are outsourced.

The Benefits

Why are so many companies attracted to FAO, either in whole or part?

Cost

The main reason is usually cost savings, driven through economies of scale and lower cost environments. For example, for part FAO there are obvious advantages to moving the accounts payable function to a dedicated accounts payable operator that can add volume at a low marginal cost.

Staffing

FAO could provide skills and talents that are not available from a company’s in-house staff. It can help to address staffing issues and labour shortages. Successful FAO may result in existing in-house employees being reassigned to higher-value activities.

Technology

FAO providers generally use superior technology and finance systems, which helps to improve processes, productivity and reporting.

Service quality

Many companies do not have all the core skills in finance, so FAO can help to reduce the risks associated with ineffective in-house processes. An outsourcing provider allows a company to use a dedicated financial service, leaving it free to concentrate on core business. Finance will then help to drive the profitability of the business. Before outsourcing any processes, finance and accounting leaders should identify their company’s strategic drivers. Crucially, they need to ascertain how FAO would complement the overall corporate strategy. For example, FAO activities might involve reducing or reassigning staff. How would this align with the company’s strategic objectives? Would it result in redundancies if staff cannot be utilised elsewhere within the business?

Outsourcing can be a trade-off between cost and quality. If you get the balance wrong, you will not achieve the benefits, either in cost or management terms.

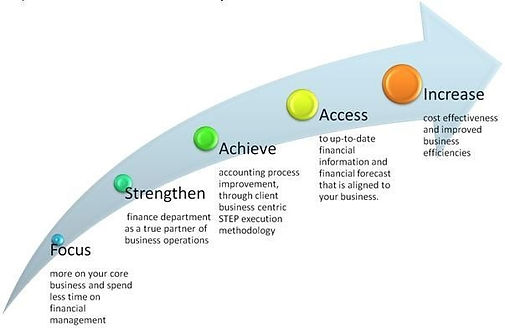

We can manage all client outsourced finance roles, providing all the day-to-day activities of a finance department.

In addition, we specialise in construction industry FAO, so we can also deal with Subcontractor Payments, CIS, Gross Applications and Retention Control.

We offer desktop and mobile dashboards to our customers, which provide real-time visibility into key performance indicators, such as debtors, creditors, stock, bank, customers who go over their credit limit, purchase orders over the internet, etc. Within five working days of the end of the month, management accounts are also produced.

For all audit, statutory accounts, tax and compliance issues, we work with our partner Hardy & Co, based in Wimbledon, London. Hardy & Co have been providing personal and corporate services since 1912, and have a client ethos aligned with our own.